Happy Mother’s Day! Nothing better than mothers. Treat them well!

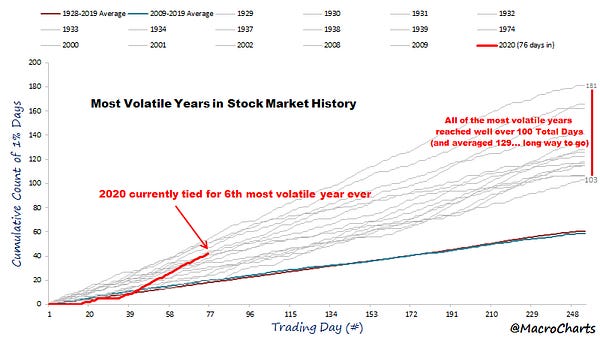

Volatility usually is not a concern for long term investors, but this craziness has my Money Market account at an all-time high. Earning interest at a .70% rate 😅

Instead of fooling around in this market like Portnoy,

I plan to store cash in a money market account for the rest of 2020. The primary reasons are:

a move DT Raleigh in July will increase expenses

to save for a significant after-tax 401(k) contribution in December 2020 and do a Mega Backdoor Roth Conversion (more details below)

This approach means I am ok with whatever stocks do between now and December. Prices go up, prices go down. Doesn’t matter. It’s a short-term game that is not worth playing.

Each paycheck is still contributing to a S&P500 fund in my 401(k).

Proven Winners

Bought $AMZN and $VTI.

Disclaimer: I am not an expert. Financial decisions based on my newsletter are your responsibility. I write this letter for educational purposes. Formulate a plan that works for you.

The position size won’t equal 100%. I have small positions that I like to watch/track and build to. Once a company’s position size is greater than $VTI/VOO, I will add it to the table.

Journal

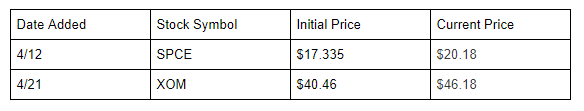

$XOM - to track what is going on with gas. Plan to sell by the end of 2020.

Selling activity since last post:

This mass selling is to prep for a Mega Backdoor Roth Conversion. Also, so I can move money into Proven Winners.

$CMG - Restaurants are a tough business. I'm not entirely sold Chipotle can keep the success they’ve built on the food delivery front. Chipotle can be a winner and has handled chaos well in the past, but figure you can invest in better industries/companies with lower expectations - $AMZN.

$BIDU - tax harvesting.

$FCAU, $MU, $BRBR - so I can buy $VTI in ROTH.

Individual positions in 401(k) - transferred these positions to a S&P500 fund since I will do a Mega Backdoor Roth Conversion every ~6 months.

$ROKU, $DLX, $HGV, $NKE, $TSE, $UIS, $UTHR - so I can buy $AMZN in ROTH.

Mega Backdoor Roth Conversion

(this not financial advice)

Below is my experience and what I believe is good advice. I’ve had 2 employers and neither have offered a ROTH 401(k) option. I want to get as much $$$ in ROTH accounts as I can which is why I’m sharing this.

To Get Started.

this tax advantage is incredible

the sooner you can get started, the better

2020 max employer + employee 401(k) contribution is $57k

for those under 50

Best article I read about this trick.

ask 401(k) plan administrator if/how you can contribute the max

Ask if rollover is possible? yes (italics are answers based on my situation)

this may not be common

Can the rollover be set to automatically happen? once every 6 months

Any fees/taxes to do this? yes, on the earnings

Please confirm the pro rata IRS rule will not trigger fees? talk to a financial advisor

The IRS has a pro rata rule regarding traditional to roth ira conversions

your tax bill from a traditional ira to a roth ira rollover incurs a lot more tax than just the earnings

i do not have a traditional ira.

this clears me from any fees or taxes. Outside of the tax on earnings.

Rollovers of After-Tax Contributions in Retirement Plans

I am good since I am only rolling over after-tax

What’s the deal with pro rata if you don't have a traditional ira?

“This could quite possibly be the golden goose of the whole arrangement. Since your contributions in excess of $19,000 are made on an after-tax basis, you can convert the non-deductible portion of your 401(k) to a Roth IRA…and do so without incurring any income tax liability on the conversion!”

“One potential problem with this transaction is the IRA pro-rata rule. Basically, you’re not allowed to earmark only non-deductible contributions for a conversion. So if you have existing pre-tax IRAs, you’ll be forced to convert some of your deductible contributions as well.

Say, for instance, that you have $90,000 in Traditional IRA assets, which came from deductible contributions. Then you put in $10,000 as a non-deductible contribution with the intention to roll it into a Roth IRA.

But when you do a conversion, you can’t convert just the $10,000 non-deductible contribution. You’ll actually have to roll over a total of 10% of your Traditional IRA assets, spread evenly across deductible and non-deductible contributions. So you’ll actually roll over $9,000 of deductible contributions and $1,000 of non-deductible contributions.

To get around this in the future, you’ll need to either roll all your Traditional IRAs over to a Roth account, or roll your Traditional IRAs to an employer-sponsored 401(k). The first option can cost you a lot in taxes (especially since you’re already in a high tax bracket), and the second could cost you earnings if your 401(k) doesn’t have great investment options.”

Final thoughts.

Linked this article a second time and copied and paste most of it within this letter. Read it.

“But that doesn’t necessarily mean that a backdoor Roth will work best for you. Here’s when you might try it:

If you don’t have other pre-tax IRAs to worry about, then a backdoor Roth won’t cost you much at all in taxes, making it an ideal option.

If you can roll your pre-tax IRA into your employer’s plan without losing valuable investment options, then you benefit from a backdoor Roth (but only after those assets are converted).

If you’re self-employed and newly starting a Solo-401(k) into which you can roll your pre-tax IRA assets, then using a backdoor Roth for additional retirement savings could be helpful.”

“As with any complex retirement move, it’s a good idea to consult with a tax professional before you attempt to actually use the backdoor Roth method. But now you know that investing in a Roth IRA is, indeed, an option, even if you’re over the IRS’s income limits.”

Beat the S&P500 by riding the winners. This is my plan to build wealth using simple trend following tactics like adding to winners, cutting losers, and buying companies that I know and understand.

No idea where/how to start investing, email me!

This newsletter was fueled by dark chocolate! 😋

Recently found out I enjoy 95% and have been eating a lot of it! Hopefully I have enough stocked up since it won’t ship well in the summer. 🌞

📚📚 recs!

Thanks for reading!

✌️ Luke