Life is precious. Black Lives Matter. All of them. RIP George Floyd. The land of the free failed you. 8:46 was how long it took - time that yourself. Police should be protecting, not perpetrating.

There’s been a lot of sad news and perspectives to consider.

Posting won’t make a racist not racist. I almost feel ashamed to post because I know it’s not enough. Nor will it make a difference.

This is rough to write because it requires an ego check and I try to live ego-free. Maybe, I’m able to live stoically because of my privilege.

Nonsense hatred has lasted too long.

The US was built with a white male perspective. Let’s recognize that one perspective fails to see every issue. You can respect your ancestors AND oppose some of their beliefs.

The problem today is those in power aren’t held accountable. Bad apples are being promoted and have positions of power. Those that hired, trained, protected the cops that killed George Floyd need to be held accountable. You gave the wrong people a badge. No excuses. You’re no good at your job.

We need to have diverse people and perspectives in positions of power. Fresh perspectives expose bad apples. New perspectives expose issues that have been missed or pushed aside.

How can a anti-leader like Bob Kroll be in a leadership position?

If you believe white male privilege isn’t a thing and/or aren’t willing to recognize it, you are a fool. You’ll look incredibly foolish in 20 years. Those unwilling to adapt are fighting evolution.

It’s a privilege of mine to not have to worry about politics. The most frustrating news for me is usually in the sports section…. Progress is slowed when people ignore problems.

Remember during these hurting times: transparency saves. Be empathetic. Not sympathetic.

@ my ego. Look out for ways to do more. Recognize.

Disclaimer: I am not an expert. Financial decisions based on my newsletter are your responsibility. I write this letter for educational purposes. Formulate a plan that works for you.

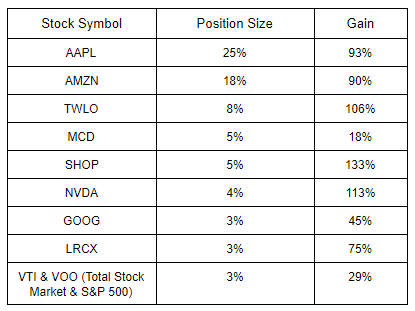

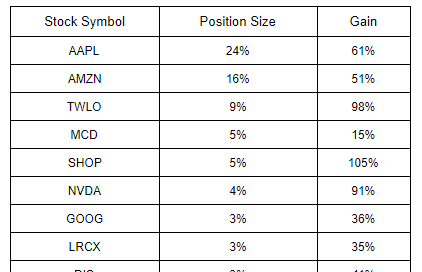

The position size won’t equal 100%. I have small positions that I like to watch/track and build to. Once a company’s position size is greater than $VTI/VOO, I will add it to the table.

Journal

Positions to track. Nothing more.

Anyone that purchased in May looks like a genius today. 😂 @ Dave Portnoy. To Dave’s credit, he’s one of the most entertaining personalities in the world.

Selling activity since last post:

Seeking solutions for police brutality. 🧠🗒️

Mega Backdoor Roth Conversion Update. 💰📈

HSA health care plans have huge tax-saving potential.

My view towards HSA has recently changed because of the Mega Backdoor Roth Conversion. My original plan was to contribute as much as possible now then reimburse myself later. Compound interest!

As the bills piled up, I’ve become anxious about filing receipts. HSA’s are kind of a pain in that sense. You have to track and store receipts to reimburse your bills. My current HSA account has an online filing cabinet which saves me from being disorganized. If your HSA account doesn’t have an online filing cabinet, it’s important to have your own electronic filing cabinet. Store them in a iCloud folder or something.

My new plan. Contribute the most. My ideal situation is to max out every nontaxable account. Pay bills with credit card. Reimburse once provided the receipt. Move reimbursed HSA money to after-tax 401K. Do Mega Backdoor Roth conversion.

📺:

Homeland: I’m on Season 3 and really enjoying this series with my new TV binge-watching rule. Peter Quinn is a hall of fame TV character.

TV-binge watching rules: 8.0+ on IMDB.

Below 8.0 and the episode is probably a snoozer. You save time by skipping it and likely can piece together what happened.

This newsletter was fueled by Vitamin C!

Not a recommendation ^, something I’m trying.

📚📚 recs!

✌️ Luke